Walmart Vs. Amazon

A Pandemic Of Opportunity: Online Grocery During A Global Crisis

It has been interesting the past several years watching two behemoths, Amazon and Walmart, battling it out to see who will dominate in global retail.

Tracy Nguyen

Technical Project Director

Tracy has more than 15 years of experience leading complex technology and software development in areas such as in-store retail, mobile and web application development, digital signage software, Alexa skills, and digital marketing campaigns.

In the last decade, Amazon saw rapid growth in its online business, while Walmart has dominated the physical retail space with approximately 11,500 locations worldwide. It’s inevitably these two retailers are on a collision course as each company expands its business to meet the growing consumer demands and expectations. Amazon is slowly adding its physical footprint through cashless Amazon Go stores, bookstores, pop-up stores, and the acquisition of Whole Foods, while Walmart has been heavily invested in its technology and online presence, including the enhancements to its apps.

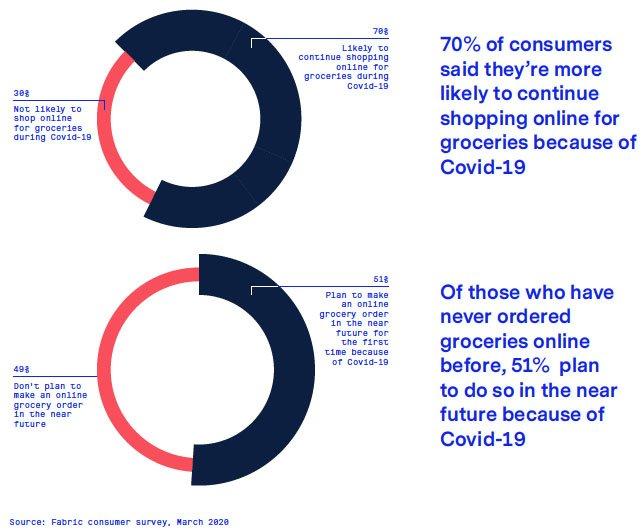

So, how are both companies performing amid the COVID-19 crisis? In the past few weeks, we have seen a shift in consumer behaviors and an unprecedented increase in online grocery shopping as consumers adhere to the shelter-in-place and social distancing mandates. According to Fabric’s report, U.S. online grocery sales will exceed 10% of all grocery sales by the end of 2020, four years sooner than originally forecast. Since March 2020, 52% of U.S. consumers have purchased groceries online and 20% are first-time online grocery shoppers. Rakuten Intelligence also reported that from March 12 through March 15, orders for “buy online, pickup in store” (BOPIS) and delivery were up 151.1%, compared to a year ago. This surge in grocery ecommerce brings new challenges for Amazon and Walmart, and their response may affect their position in the retail landscape.

Companies performing amid the COVID-19 crisis

Although Amazon and Walmart have already hired more than 100,000 temporary workers to keep up with the product and service demands (Amazon is looking to hire an additional 75,000 workers to help with the restock and delivery), they are still finding it difficult to keep essential items in stock and continue to experience delays in delivery services. However, Walmart’s physical footprint gives it an advantage, as the retailer is using its stores as warehouses for online orders. It is better equipped to handle and service the growing demands for grocery delivery, curbside pickup or BOPIS, and in the process, out-performing Amazon.

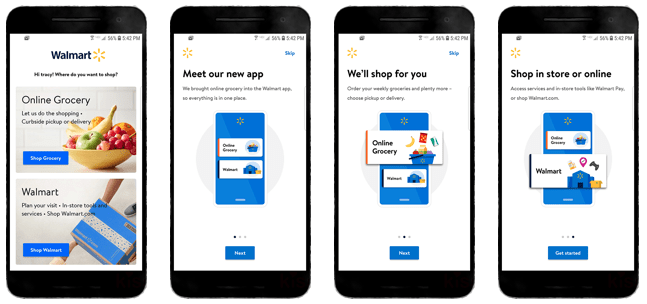

According to App Annie, as of April 5, the Walmart Grocery App ranked #1 as the most downloaded shopping app in the U.S. This is a 460% growth in average daily downloads compared to its January 2020 performance, surpassing Amazon by 20%. However, the Grocery App will be discontinued by this summer; it will be incorporated into the recently updated Walmart app, providing customers a more comprehensive and user-friendly experience by allowing users to shop grocery and non-grocery products within one app.

The Walmart app

While Walmart stores remain open (at reduced hours, with pickup or delivery available for next-day or two-day options), Amazon is having difficulty keeping up with the increased demands. Customers are no longer offered same-day or next-day delivery; some orders may take up to a week or two for delivery. At the beginning of March, Amazon announced they would no longer accept non-essential items at their warehouses until April 5. This was a devastating blow to third-party sellers. Amazon also announced they have stopped taking new customers for Amazon Fresh and Whole Foods Market grocery delivery service – potential new customers have been put on a waiting list. However, for existing customers, a new feature will allow them to “secure a time” to shop. Most recently, three Whole Foods Markets became “dark stores.” These “dark stores” are no longer open to the public but rather, for employees to fulfill online orders for delivery or pickup. Despite their setbacks, consumers continue to flock to Amazon for much of their product “needs” regardless of the delivery lag time.

Who will come out on top after COVID-19?

No doubt this pandemic has caused significant disruption to both retailers’ day-to-day business, as purchase behaviors shift and demands for sought-after items cause a strain in companies’ supply chains and employees. But, during this trying time, the company that best responds to the needs of consumers and converts first-time shoppers to repeat customers will take the lead. If Amazon’s inability to fulfill and keep pace with consumer demands continues, Walmart has an opportunity to swoop in and capture the lead as online grocery shopping goes mainstream and obtains new customers. And new customers with a positive experience can lead to loyal customers post-pandemic.

To learn more about how Velocity Commerce Group can help, please reach out to us on LinkedIn, or on our website.

Contact Us

Let’s Talk

Find out how we can create value for your business and drive your commerce performance forward.