A Watershed Moment

For Online Grocery Shopping

We are living in challenging and unprecedented times, as we learn more about COVID-19 each day, and its global presence.

Joe Scartz

Chief Digital Commerce Officer

Joe Scartz is an accomplished marketing executive, and as Velocity Commerce Group’s fearless leader, he is responsible for overseeing all digital commerce strategy and execution, including mobile, social, and traditional e-commerce.

No amount of additional context related to health considerations or staying safe from us here at Velocity Commerce Group can augment what you are already getting from multiple sources. That said, let’s have a discussion on the commerce industry and try to contextualize what is happening today.

For several years, we (Velocity Commerce Group, TPN’s digital consultancy), have been tracking the growth of digital grocery commerce; we have seen steady gains in the category that once seemed impossible, particularly in the last two years. We once believed that BOPIS (Buy Online, Pick Up in Store) and Amazon’s purchase of Whole Foods served as the greatest catalyst to push online grocery shopping into the mainstream. It turns out that, while important, those were just stepping stones; vessels for behavior change but not a true breakthrough moment.

For reasons we wish we didn’t have to accept, COVID-19 is requiring that people stay home, order staples and groceries and practice social distancing. We assert that this year will represent the tipping point, where many of these shoppers never go back to the way they grocery shopped before. New customer behaviors are being tested, created and possibly cemented during this time.

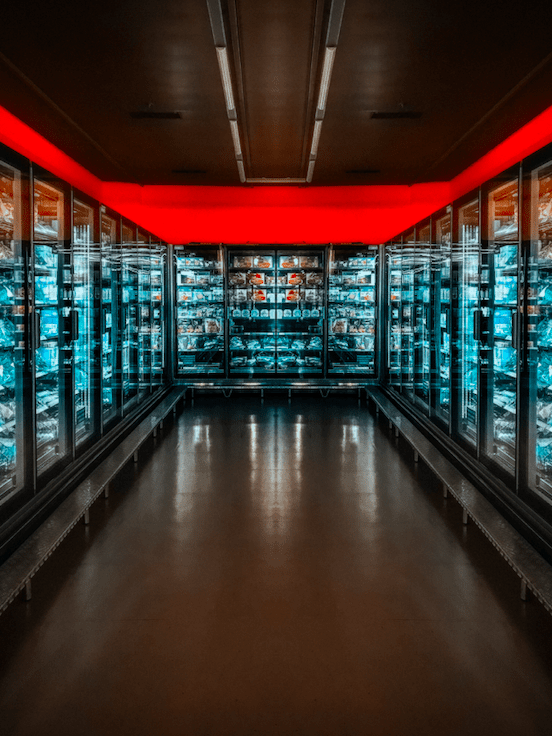

Online grocery shopping hits a high due to COVID-19

With millions of new baskets created, shopped and bought online, how will online grocery react?

We believe that a cascading stickiness will play out, accelerating the rate of adoption and drive the total online grocery category size beyond the $100 billion estimate that Nielsen and FMI boldly made a couple of years ago. We believe that the percentage of total online grocery sales will rocket toward 10% of category sales more quickly than previously predicted. We believe all of this because online grocery shopping saves time, is transparent, is convenient and allows you to shop how you want to shop with the ability to choose how you want to receive product the way you want to receive it.

In short, we have reached the critical turning point in online grocery shopping where it moves from a rounding error to real numbers and everything from brand shopper marketing programs to retailer inventory, assets, media, strategy and merchandising need to be ready for the acceleration…or be left behind.

Contact Us

Let’s Talk

Find out how we can create value for your business and drive your commerce performance forward.